Kremlin Keeps Cutting

Follow our Instagram page and Linkedin Page !

Sign up for our email list to receive each article in your inbox!

Hi all,

Hi everyone, this week there have been some promising advancements in Inflation expectations, Russia continues to play hardball with the west, a prominent hedge fund manager makes sees weakness in the FX markets, and a French asset manager has gained attention for the wrong reasons. Enjoy!

A peak at last?

According to leading indicators the rate of global inflation is at a peak and is set to slow in the coming months. Key prices in the supply chain that are closely watched by economists are beginning to flatten out in terms of price rises, which is likely to have a big impact on the price of goods and services globally. Some of these key prices include the costs of factory gates, shipping rates, and commodities.

This would be welcome news for central banks who fret about further interest rate rises plunging their economies into harsher recessions in 2023. Global inflation hit a record 12.1% inflation in October, although there is a chance that a strong recovery in the Chinese economy post-Covid could mean a further jump in energy and commodities. Read Peter’s latest article on his long-term outlook regarding energy and commodity markets.

Growth Projections for the Global economy in 2023, Source: IMF

Russia sharpens its axe

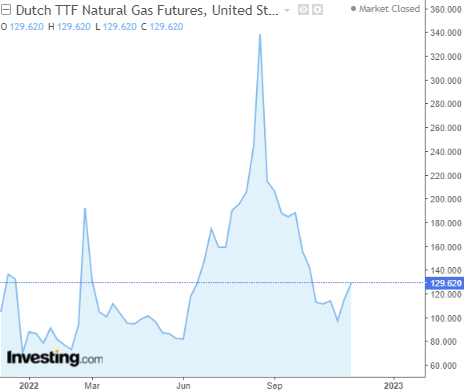

Speaking of energy costs, the Kremlin has this week threatened to make further cuts to gas supply to western Europe via the last remaining pipeline between east and west. Russian accusations that Ukraine has been taking gas supplies that run through the country to Moldova have been denied by Kyiv. This news is likely to ruffle the feathers of the energy markets coming into the harsher winter months. Since the invasion of Ukraine ten months ago, Russia has cut gas supplies in all but one of its pipelines to the west, meaning there is only 10% of the pre-war gas supply currently – a major factor in the current cost of living crisis.

European Gas Benchmark in 2022, Source: Investing.com

Pressure on the peg claims Ackman

Billionaire Hedge fund manager and founder of Pershing Square Capital, Bill Ackman, has announced a large short position by his company on the Hong Kong Dollar, claiming that its current exchange rate peg to the US Dollar is no longer sustainable and will soon break. The large short position was entered via put options on the Hong Kong Dollar, which will follow suit of previous failed positions taken by other investing legends such as George Soros.

The Hong Kong Dollar’s currency band(which it must stay within to remain pegged to the US dollar) has been tested at its lower bound several times in 2022, causing intervention by the Hong Kong Monetary Authority to pep up the exchange rate. With various economists stating the Hong Kong Dollar is under no stress, alongside the Hong Kong Finance Secretary Paul Chan’s statement earlier this month, “If you bet against the Hong Kong Dollar, you are bound to lose”, it is difficult to see how Ackman can profit in his short stance. Maybe he knows something the market does not…

Hong Kong Dollar - Pegged to US Dollar for over 40 years, Source: tradingview

H2O pours client capital down the drain

French Asset Manager ‘H2O’ have found themselves in the mud this week as financial authorities in the country are seeking to impose a record €75 million fine on the company for making illiquid investments to German Financier Lars Windhorst. Windhorst’s investment firm ‘Tennor’ are in debt hundreds of millions to H2O, but there has been no sign of H2O chasing up on the debts of various investments, some of which have failed spectacularly. Investments ranging from failed business ventures to illiquid bond holdings have lost huge amounts of money for institutional clients such as insurance companies and pension funds.

This has brought questioning on the relationship between the two firms. An investigation by the Financial Times in 2019 brought to light the scale of losses taken by Tennor and hence by H2O. The fine imposed on the asset manager has come alongside a 10-year ban from the industry for H2O chief Bruno Castes – seen by many as a slap on the wrist. The company is also under investigation by the UK’s Financial Conduct Authority.

H2O Investments in Lars Windhorst, Source: Financial Times

Thanks for reading! Have a good week.

Patrick

Disclaimer

This communication is for informational and educational purposes only and should not be taken nor used as investment advice, as a personal recommendation, or solicitation to buy or sell any financial instrument. This material has been prepared without considering any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or structured product are not, and should not be taken as, a reliable indicator of future performance. I assume no liability as to the accuracy or completeness of the content of this publication.