How to Short a Currency Pair

Hi all, this week the CCP has taken action as a result of increasing stress on the Chinese economy. There are also changes taking place within the Federal Reserve - Jay Powell is not messing around. There have been some interesting insights into how institutional investors are currently positioning themselves, and while inflation is currently putting a dampener on the western world, all is well for the Saudis. Enjoy!

Covid Conundrum

The Chinese government has announced new economic stimulus measures in an attempt to offset the slowdown in growth that has come due to Xi Jinping’s zero covid policy. These stimulus measures come in the form of mortgage lending rate cuts, with the five-year loan prime rate being cut from 4.6% to 4.45%. This is the largest rate cut ever recorded by the Peoples Bank of China, highlighting the severity of the situation the Chinese economy is in.

The intended results of this measure will be to directly reduce the borrowing costs of consumers across the country, giving them more disposable income, as well as to help the property market bounce back from its worst downturn in years by making it more affordable for new buyers to secure a mortgage. This move, alongside news of easing lockdowns in China, sent global equities higher on Friday, as global supply chain issues may subside.

Bulking Season is Over

On Tuesday, Chairman of the Federal Reserve Jay Powell stated that he will continue raising interest rates until inflation falls to a ‘healthy level’. It was also cautioned by Powell that this could come at the expense of a rising unemployment rate in the US. These comments have concerned investors that it will also result in a more severe downturn/recession later this year. In addition to this, the Fed has now stopped buying bonds (quantitative easing) and will start to cut its massive $9tn balance sheet from next month. The unemployment rate is currently 3.6%, but this could rise in the coming months.

Cash is King

Large institutional investors across the globe are holding more cash, according to statistics from Bank of America. Average cash holdings now sit at 6.1% across the likes of pension funds, asset managers, and hedge funds, reflecting the increasing concern over the outlook of stock markets globally. The NASDAQ exchange has dropped by over 25% this year, with investors moving out of tech steadily over the last 5 months, due to various economic and political factors that aren’t hard to see.

We are currently in what would be described by the macro quadrant as a ‘risk off’ period, and more specifically in the region of ‘Stagflation’, with rising inflation and declining growth. The Spark Portfolio has acted in advance of this by holding 15%+ in cash since November 2021. Have a look at a more in-depth explanation by Peter on how the Macro Quadrant can be applied to align an investment portfolio with the wider environment.

Source: US Bureau of Labour Statistics

99 Problems But Oil Ain’t One

This week Saudi Aramco, the largest oil exporter in the world, posted its biggest quarterly gains since it was first floated publicly back in 2019. The largest sponsor in Formula 1 posted a net income of $39.5bn for 2022 Q1, an 82% increase from the same period last year. The success this quarter has of course come as a result of sky-high crude oil prices caused by the Russia – Ukraine Conflict and the ever-increasing energy sanctions that have come with it.

Saudi Aramco shares have risen 27% in 2022 and last week they surpassed Apple as the most valuable company in the world, with a market cap of roughly $2.3tn. 98% of the shares in the company are owned by the government of Saudi Arabia. The success of Saudi Aramco is vital to the Saudi Government and economy, so they are making the most of high oil prices while they can, as climate change and government carbon neutrality goals will inevitably have an impact on this business in the next few decades.

Hope you enjoyed this week’s Market Wrap!

Patrick

Selling Short in a Bear Market

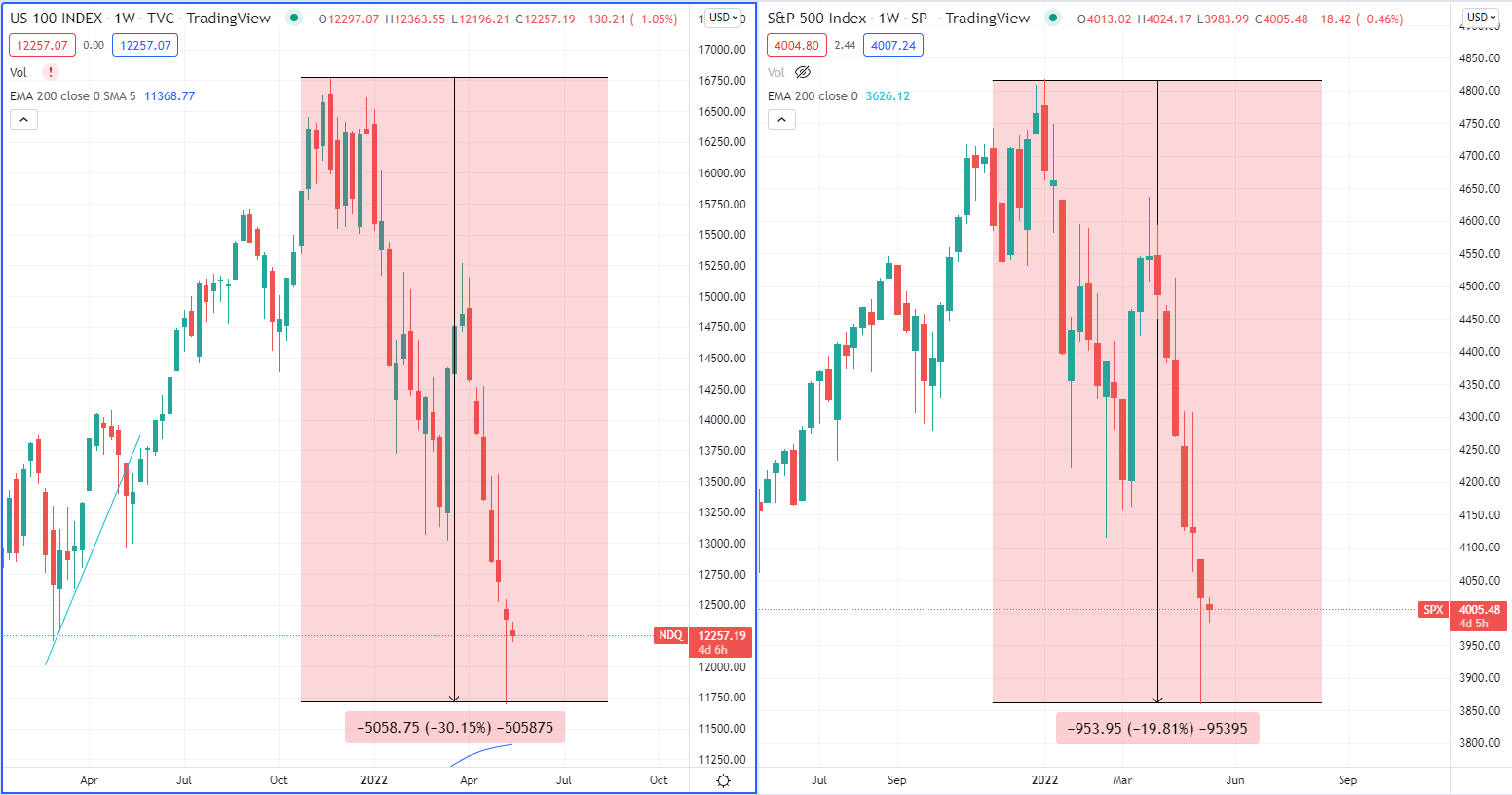

Markets have seen serious ‘blood on the streets’ lately, with the S&P500 printing a painful 6 consecutive red weeks and the NASDAQ reaching a low of 30% from the market top last year, well into bear market territory. The bond market has offered no remorse either, failing to act as a hedge for stocks, something it has done in previous periods of economic uncertainty. Even crypto and gold have fallen over the last couple of weeks. Traders appear to be running out of profitable options for taking long swing positions as we edge towards a stagflation-induced recession.

Recent sharp declines across markets (NASDAQ, S&P500, Treasury bond and gold), Source: TradingView

A popular play for traders in risk-off market conditions like these is to enter short positions, the opposite of a long. This is a bet that the underlying asset will fall rather than rise. In today’s article, I will explore what it means to ‘go short’ with an example of a short trade and why they can be advantageous to a trader’s short-term strategy in bearish market conditions.

Shorting a Forex Pair

We will focus on a short trade in the foreign exchange (Forex) markets, in particular shorting the Euro Dollar (EURUSD) currency pair. A currency pair involves a base currency (EUR in this example) and a quote currency (USD in this example), as seen in the image below. Each currency quote is provided as a ‘two-sided transaction’. When you short sell a currency pair, you are selling the base currency and buying the quote currency with the expectation that the value of the currency pair will fall.

So, when shorting the EURUSD currency pair I’m selling Euros and buying US Dollars. This means no ‘borrowing’ is necessary, in contrast to shorting a stock, which requires the trader to initially borrow shares of the stock to take a short position. This makes shorting in the forex markets much less complex and more cost-effective than shorting in the stock market.

All you need to know about the fundamentals of the forex market can be found in Peter’s recent article ‘Why Currency Matters’.

EURUSD Short Swing Trade Set-up

Just to clarify, the EURUSD short below is only an example trade and not one I traded myself. It is however a great example of how fundamental and technical analysis can come together to provide a great opportunity.

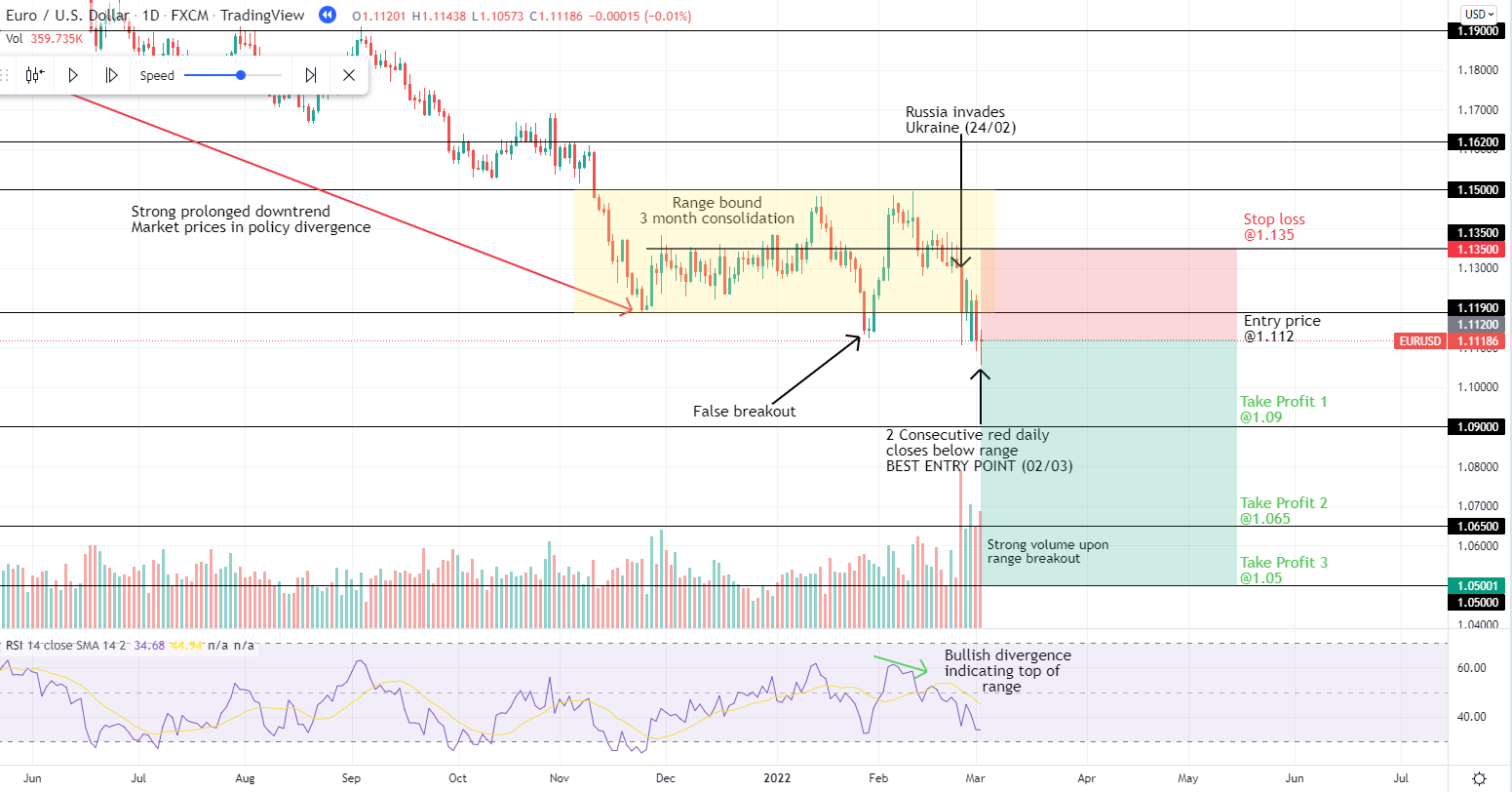

EURUSD has been in a bearish downtrend from June 2021 on the higher time frames (1 day/1 week) which began to get particularly violent from September onwards due to the Federal Reserve initiating a hawkish pivot on their monetary policy stance. This sparked a policy divergence between the Fed and the European Central Bank (ECB). These policy divergences can lead to very profitable macro swing trades in the forex markets. This is because if one central bank is tightening policy (raising interest rates) while another isn’t, it typically leads to a stronger currency for the country tightening relative to the one still easing. Therefore, in this example, the USD got stronger relative to the EUR. The USD is likely to remain stronger relative to the Euro as long as this monetary policy divergence continues.

The proposed trade comes after a clear 3-month consolidation (yellow box above). However, with little upward strength, EURUSD is in a prime situation to break below the range (at 1.12) and continue falling. Any new developments that would suggest a further weakening of the Euro or strengthening of the US Dollar would likely cause this fall (or weakness).

This development came with the Russian Invasion of Ukraine at the end of February, causing obvious pain for the Euro. The event brought EURUSD to the bottom of the range on the day of the invasion (February 24th) but it did not close below it. To enter a trade during such a volatility-inducing event would be overly risky. The best approach to entering a trade here would have been to wait patiently. With two consecutive red daily closes below the 1.12 level on strong volume, the following week on March 3rd presented a good opportunity to enter a short position.

Importance of the DXY (Dollar Index)

The US Dollar Index (DXY) is a measure of the value of the US Dollar against a basket of currencies used by US trade partners. The index will rise if the Dollar strengthens against these currencies and fall if it weakens. A developed understanding of trends and price action of the DXY is therefore important when trading forex. As seen in the DXY chart below, EURUSD trades almost inversely to the DXY.

The uncertainty instilled in markets from the invasion of Ukraine and massive spikes in oil prices as a result sparked a risk-off move. Investors bought the US Dollar as it is the world reserve currency, and sold other currencies like the Euro. This can be seen from the DXY printing a strong green candle as it breaks out of the 3-month range on March 1st. This occurs at the exact same time as the EURUSD falls below the range, strengthening the probability of downside continuation for the EURUSD.

EURUSD in Orange, DXY candle chart, Source: Trading View

Outcome of the Trade

Risk management is extremely important when shorting since your losses are limitless. When buying (going long) an asset, your max loss is 100% of your investment since an asset can’t go below a price of zero. However, if you are short, an asset has an unlimited upside so your potential loss is limitless. Hence a sensible stop loss would be the 1.135 level. The take profit levels would have to be taken from key support levels from price action over the past 5 years since the price has not seen those lower levels in quite some time. The chart below shows the success of this short position with take profit levels all the way down to 1.035.

An even safer way to play the trade would have been to wait even further for the Ukraine invasion event to play out. In doing so the retest of the 1.12 level toward the end of March would have been a great entry position. By this stage, the Fed had become even more hawkish due to the increased threat of inflation from energy price surges causing the EURUSD divergence to increase. This version of the trade would also likely be less prone to emotional trading as the trader who entered the position at the start of March may prematurely exit the trade as the price retraced back up to the 1.12 level.

I hope you enjoyed this week’s article!

See you next week,

Ronan

Disclaimer

This communication is for informational and educational purposes only and should not be taken nor used as investment advice, as a personal recommendation, or solicitation to buy or sell any financial instrument. This material has been prepared without considering any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or structured product are not, and should not be taken as, a reliable indicator of future performance. I assume no liability as to the accuracy or completeness of the content of this publication.