Entering the Metaverse

Click here to sign up for our weekly articles to be sent to your email inbox!

Until 2020, Facebook and Instagram (both owned by Meta) were the stalwarts of social media. The company has grown from a messaging platform for students at Harvard, coded by its founder from his bedroom, to one of the most recognisable brands in the world. But it is not resting on its laurels. The Founder and CEO Mark Zuckerberg is now pushing the company beyond the realms of social media and into the Metaverse, and at the current share price, I believe it is a great time to get on board.

If it’s free, you’re the product

As the saying goes, ‘If it’s free, you’re the product’. The backbone of Meta’s business is driven by advertising across its platforms. FB sells data gathered on its users so companies can target ads at the groups most likely to buy its products… and this works. Revenue for Meta’s family of apps – Facebook, Instagram, and WhatsApp – came in at $115bn for the year ending December 2021. The shift to online living and working due to the pandemic is here to stay and Meta (in my view) is at the forefront of this, regardless of what the company (and stock market) suggests about competition - more on this below.

Meta’s presence in the western world has now matured and it is not experiencing the growth it once did. The social media giant recognises this and is moving into new regions, aiming to drive growth further through emerging markets in Asia and Africa. There are expected to be 1.3bn Africans with an internet connection by 2030, and smartphone affordability is exploding across the continent - part of the reason I hold Airtel Africa in the portfolio. Also, India being one of the fasting growing and most densely populated countries in the world is expected to experience a 45% increase in internet penetration within the next five years, meaning 900m out of 1.4bn population will have access to Meta‘s apps. Meta’s shares gapped down 25% on the day of its earnings release due to falling daily active users (DAUs). However, the company’s strategic partnerships with mobile carriers in developing markets to offer its family of apps pre-downloaded onto user’s smartphones has led to 66m new users in the second half of 2021. This will help to offset the slowing growth Meta is experiencing in western markets. Other big tech companies have also cottoned onto this growth with Google committing $1bn to digital transformation in Africa, further showing the excitement around such markets.

Alongside Meta’s ad revenue from Facebook and Instagram, it has the opportunity to monetise WhatsApp, which currently contributes nothing to ad revenue (at least directly anyway). There have been whispers of WhatsApp bringing in crypto payments, which would drive revenue through commission and fees if users are able to transfer crypto to contacts through the app.

Into the Metaverse we go

Aside from Meta Platform’s legacy social networks, the company has begun to heavily invest in the Metaverse through its Reality Labs division. This side of the business is currently making a loss but is generating $2.3bn in revenue, and Zuckerberg is betting big on the future of this segment. Meta’s capital expenditure (CapEx) has grown exponentially in recent years, rising from $4.5bn in 2016 to $18.6bn this year, and is expected to be around $30bn from 2022-2026. The segment includes the Oculus gaming platform and headset, which allows users to play and interact in the metaverse through augmented and virtual reality - see an explanation of the metaverse here. The Metaverse allows FB to diversify revenue and tap into the next generation of the internet (Web 3.0). This space, which includes non-fungible tokens (NFTs), cryptocurrencies and alternate universes where players can play games to earn crypto (play-to-earn) has exploded in popularity over the past two years, but this is only the beginning. The number of crypto wallets today stands at an estimated 230m. Putting that into perspective, this equates to the number of internet users in 1998. Although it may be several years before the metaverse and virtual reality become mainstream, plenty of businesses are getting involved, with Nike acquiring NFT creator RTFKT, as well as companies like JP Morgan and Chipotle leading the charge. With patents continuing to rise (see below), there is a huge opportunity for Meta to tap into this growth.

Patents and user growth is exploding to the upside, Source: Financial Times

President Biden’s executive order to examine cryptocurrencies will only stoke growth further, as regulation will mean large institutions (whales) will be able to get involved. Finally, the turmoil around the world is also driving user growth, as there is a high correlation between crypto adoption and distrust of a country’s government. For example, certain African nations, as well as Turkey and Venezuela where inflation is skyrocketing, have seen huge adoption of crypto as a store of value. This all feeds back to long-term growth for the metaverse and FB.

Cheap as chips

Currently, FB’s Reality Labs division only accounts for 2% of revenue but is eating the majority of the company’s Capex. Zuckerberg is making a big bet on the Metaverse paying off. Personally, I am sold on the Metaverse being the future of the internet but am unsure of when this will become mainstream. At FB’s previous valuations I was uncomfortable taking that risk, as you were paying a higher price for that bet.

Today, the company is pricing ridiculously cheap, considering only its social media platforms. The company trades at a 7.9x EV/EBITDA multiple (see below), the cheapest it has ever been - even after its disastrous IPO. I use an EV/EBITDA multiple because it excludes cash (since Meta has a net cash position of $33bn), but mainly because the company is spending a huge amount of capital expenditure as mentioned. I believe using a Price-to-Earnings (PE) ratio to value Meta is unfair as it penalises the company for reinvesting its cash for growth (higher Capex means lower earnings and therefore higher PE ratio). Also, higher CapEx means a lower free cash flow figure, which is why I chose not to use this ratio (however even with this high Capex the company has a 5.3% free cash flow yield today – better than any western government bond).

Meta’s return on invested capital (ROIC) averaged 20% since 2016, so its high CapEx should lead to higher growth at some point in the future. On average, since FB IPO’d the market was willing to pay 16x EBITDA for the company’s shares. I believe this is a fair multiple for the company if it succeeds in continuing to drive growth through emerging markets, which implies a share price around $360, not accounting for any revenue increase if the Reality Labs Division succeeds.

Meta’s EV/EBITDA is at all time lows, Source: TIKR

What is there to worry about?

Companies that control a market tend to downplay their dominance, and those that are in highly competitive markets tend to overstress their merits to attract attention (taken from PayPal founder Peter Thiel’s speech). As I highlighted, Facebook has been the stalwart of social media until 2020, when TikTok exploded onto the scene. Zuckerberg is a very shroud operator, and on FBs latest earnings call he pointed to huge competition by TikTok being the reason for Meta’s weaker earnings. I believe he has done this to get the anti-trust regulators off his back, which seems to be a very smart move. Regulators have been trying to break up big tech for years, and the rise of TikTok is a great excuse for Zuckerberg to point to higher competition in the social media space. TikTok currently has 138m users in the US, and Instagram’s has 115m. This platform has incorporated ‘reels’ into its platform to become more competitive with TikTok, and the network effects of Meta are too strong to compete with.

TikTok is very much a Gen Z platform and has little to no penetration with older demographics. It also does not come close to Facebook in terms of network effects. Facebook has 2.9bn monthly active users, which should continue to grow globally as outlined above. If you want to reach out to an old colleague or family member you haven’t spoken to in years, you go to Facebook. TikTok is not used for messaging, and I doubt it ever will be. Although TikTok has the most downloaded and popular app in 2020/2021, Meta’s family of apps continues to dominate (see below). No one comes close. After the Cambridge Analytica scandal during the 2016 Trump Presidential election, many called for a boycott of Facebook, but here we are six years later with an even bigger user base.

Betting on Management

The success of this stock will depend on execution by management. Management’s ability to continue to raise DAUs through movement into African and Asian markets, as well as its ability to execute on Reality Labs is paramount to FB’s success. This is a huge bet by Zuckerberg, and I will continue to monitor Meta’s progress with regard to both. If he can execute on the movement into emerging markets, this should give the business scope for further growth through regions with better demographics and stronger growth relative to the west. The Metaverse may be a few years away from becoming mainstream, but if it pays off shareholders in FB will be handsomely rewarded. Another risk surrounding Meta Platforms is the state of the global economy. If a business experiences margin compression and reduced profits due to soaring costs, the first place it is likely to reduce expenditure is on selling, general, and administrative (SG&A) – i.e. advertising. I continually monitor the global economic backdrop and at current prices, I feel this downside is already baked in.

As a shareholder, at FB’s current share price I am getting a free call option on the success of the Metaverse, and if it doesn’t succeed, I have the comfort of the legacy social media business to fall back on for both reliable revenue and strong free cash flow, which stood at $39bn for 2021. This is why, despite a lot of short-term noise surrounding tech, I am now comfortable holding the stock.

The hype is over

Consulting firm Gartner created a graph called the Hype Cycle (see below), which provides a graphic representation of the maturity and adoption of technologies and applications. This is a great way to explain what has happened to many emerging technologies today. During 2020 we were in the ‘Peak of inflated expectations’ phase, where many believed the technology would take over today – think cannabis, renewables etc. We discounted ten years’ worth of growth in as many months as companies such as Plug Power rallied over 1000%. We have now got over that phase and many of the stocks promising to be the next big thing are down anywhere from 60%-99%. Investors are now realising the irrationality of pricing seen during 2020, and we are now moving toward the trough. This means it is time to start seeking bargains.

The Hype Curve, Source: Gartner

With regard to the overall market, we have endured significant volatility over recent weeks. If this was to increase further, we could see more downside in prices. Large investment funds (and banks for that matter) use sophisticated models called VaR – Value at Risk – models to calculate their exposure and downside risks. If volatility increases, these funds will be forced to derisk (sell positions to reduce portfolio risk/volatility). This could lead to capitulation selling as these whales start to unwind positions. In this environment, it is essential that you do not overtrade, as 10% swings in price are more common. I am relaxed and sitting on my hands at present.

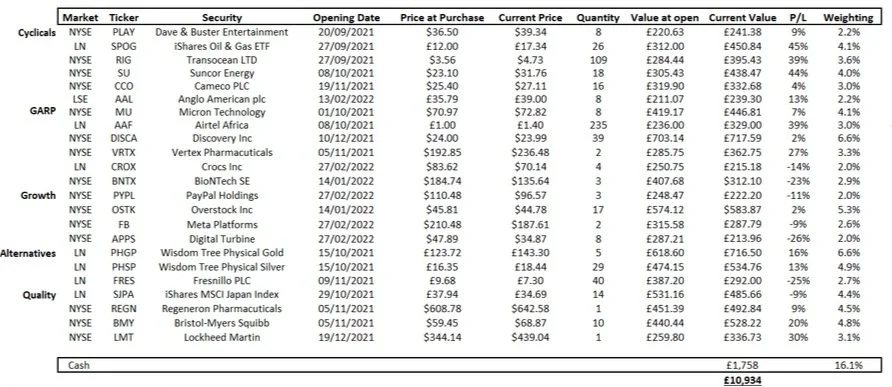

Portfolio Return YTD: 3.2%, vs S&P500: -12.4%

Total Return since inception (20/09/2021): 9.3%, vs S&P500 Return: -3.5%

Let me know your thoughts by emailing me at thesparknewsletter@gmail.com

I will cover Digital Turbine (APPS) next week, as I thought the article would be too long if I included it this week.

Until next time,

Peter

Disclaimer

This communication is for informational and educational purposes only and should not be taken nor used as investment advice, as a personal recommendation, or solicitation to buy or sell any financial instrument. This material has been prepared without considering any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or structured product are not, and should not be taken as, a reliable indicator of future performance. I assume no liability as to the accuracy or completeness of the content of this publication.