The Melt Up Rally

Click here to sign up for our weekly articles to be sent to your email inbox!

I have gone heavy on articles relating to interest rates, inflation, and liquidity in recent weeks. I am sure you will be glad to hear this will be the last one for a while. The reason for me over-egging these topics is because these are the only three things the market and investors care about at present. I hope you found value in these articles, and they have helped you develop your understanding of what is driving markets today. From next week onwards, I will turn my attention to attractively priced companies. If you would like me to analyse any companies/stocks, please email me your suggestions at: thesparknewsletter@gmail.com.

The Melt-Up Rally

The yield curve is inverting, consumer confidence is at an 11-year low, inflation is running wild, there are seven interest rate hikes expected this year, Ukraine-Russia tensions are at boiling point, and I am talking about a rally. Have I gone mad?

The Signals

As investors, our main job is to decipher between noise and signals. At present, the Federal Reserve (Fed) is still participating in quantitative easing. Despite this, hawkish central bank action is already priced into the market, with seven interest rate hikes priced into the market for 2022. This, alongside the other issues mentioned above, could mean we are at peak fear at present (see below). The market has had everything thrown at it recently and it is still holding relatively strong (down only 9%). A correction is defined as a price move down circa 10%, with a bear market being a 20% market decline or greater. There is very negative sentiment in the market at present, with many market commentators calling for a recession and bear market. The US’ last quarter’s GDP growth was 6.9%, therefore a recession is impossible since it is defined as two consecutive quarters of negative growth. I believe that seven rate hikes are at the upper end of what the Fed will do, and markets have already priced this in.

Are we at peak fear? Source: Twitter

I focus on the Fed because their actions and the effect these actions have will be mirrored by other major central banks. Also, as the saying goes, if the US sneezes everyone catches a cold i.e. if the S&P500 tanks, so will every other market.

On top of this, downside protection is at a significant high (see above). Put options (see bottom of this article for a definition) used to protect portfolios against downside moves. The above chart shows that the value of Puts purchased on the S&P500 today is at the same level as the peak of the COVID-19 pandemic, and the trauma of the 2011 European debt crisis. If these puts are sold, a huge relief rally could ensue. In addition, any easing of tensions with Russia and Ukraine could contribute to this rally further. There is a lot of negativity priced into financial markets, meaning any signs of positivity could see a rally higher.

The main issue is once again the dreaded word inflation. We are currently facing a period of stagflation – slowing growth and higher inflation. Oil is the input cost for everything in an economy. From mining for silver, in the case of Fresnillo, or transporting products to customers in the case of Asos, oil is used. Therefore, oil could be a double-edged sword. A rising oil price will benefit my holdings in iShares Oil & Gas, Suncor, and Transocean, but will likely lead to price squeezes across the board for many of my other holdings. A continued rise in the oil price could hinder economic growth further, as well as contribute to even higher inflation. If inflation doesn’t turn lower, we could be in big trouble.

Inflation – My Base Case

I believe that inflation will begin to fall in the coming months. Semi-conductor shortages meant that used car prices rocketed, and the shunned energy sectors chronic underinvestment caused prices of essential commodities like oil and gas to soar. These two aspects contributed to the soaring inflation figures over the past year.

Oil and Gas have come a long way, rising almost 100% since this time last year, and exposure to this sector among institutions is the highest since 2007. Any resolution of tensions in Russia could see oil and gas prices take a nosedive. Overall, Inflation is now moving against gravity as the base effects of the pandemic begin to wear off this year.

Therefore, I am reducing exposure to this sector as I cannot see the huge gains we have seen of late continuing into the future. I may be early out of this position, but I would rather bank some gains and reduce exposure to this sector than remain highly exposed to any drop, considering I currently have 16% of capital invested in energy. I am therefore selling 50% of iShares Oil & Gas ETF (SPOG).

If I am right, and inflation does begin to fall in the next few months, then it will restore some central bank credibility and means they may not need to raise rates as hastily as anticipated. This will help stabilise long-duration assets like growth stocks and bonds, creating opportunity. If I am wrong, and inflation continues to rip higher, then commodities will sell off anyway and a bear market will likely ensue. Therefore, I feel the risk to reward in SPOG has diminished substantially since I opened the position, so it is time to move on.

What happens if inflation rips higher?

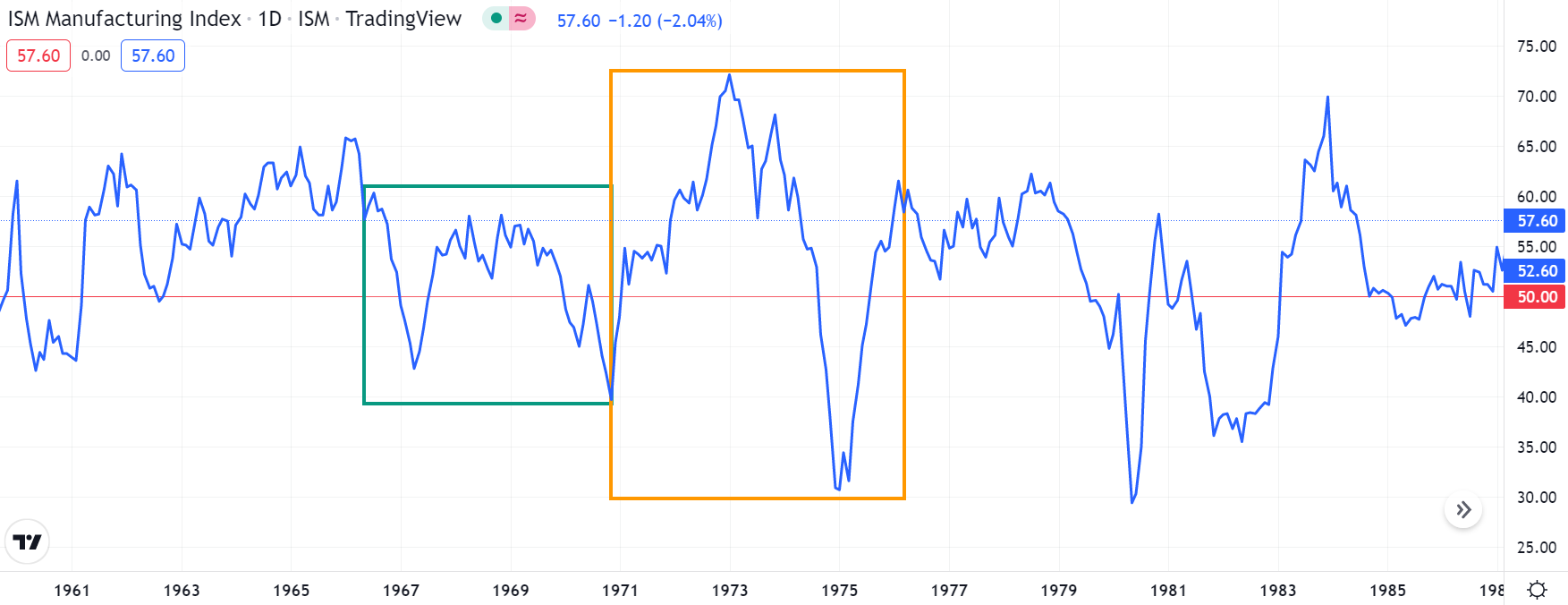

Looking back at history, the last time we witnessed inflation as high as it is today was in the 1970’s. From December 1968 to August 1970, there was a bear market (20% decline) partly created by a rising inflation and interest rate environment. GDP growth (growth of the whole economy) was poor during the period. This was predicted by ISM Manufacturing data (a leading indicator of GDP growth), which remained in small expansion or contraction coming from out of the previous crash (1967) – see green box below, above 50 is expansion, below 50 is contraction.

Coming out of this bear market, the S&P rallied again as ISM data started to move back into expansion in early 1971 (orange box below). This rally continued into 1973 before the ISM numbers rolled over and the S&P500 entered an even deeper bear market, falling 50% from peak to trough. As you can see, the ISM PMI data rolled over in February 1973 (just as the market topped). Inflation was rampant during the period, rising from 4% to 11% between May 1972 and April 1974, and these rising costs hurt many companies. Because of the surging inflation at the time, Paul Volker (the Federal Reserve Chair at the time) famously raised interest rates to an astonishing 18% to kill it. 18% is an unfathomable level today, with inflation at 7.5% and interest rates still at 0.25% in the US. In real terms (minus inflation), the S&P500 didn’t produce any gains between 1972 and 1974. GDP growth was awful during the period and didn’t improve until 1976 when inflation was killed. High inflation and interest rates destroyed companies during this period of the 1970s, explaining the weak economic growth and poor stock market returns.

ISM Manufacturing PMI 1960-1990 - a leading indicator of GDP Growth, Source: TradingView

Unless central banks around the world can control inflation again today, businesses will be destroyed and this will be reflected in the stock market. If interest rates rise and inflation does not fall, a bear market will become increasingly likely.

Although I do believe inflation will begin to moderate, and then fall, I don’t feel there is any rush to pile into growth stocks now. As we can see, the market is still selling these stocks indiscriminately. I would like to see inflation begin to moderate before I transition into growth, rather than prepositioning for this outcome. My reason for doing so is because there’s a chance of another hot inflation print next month, which would hit these stocks further.

“No matter how fast markets are moving, taking a little time before pulling the trigger on a decision to try to ensure it is a well-reasoned one is unlikely to be a mistake.”

Thank the paper hands

When we purchase a stock, we are an owner of that business. When we buy stocks with good free cash flow, we are trusting the management team to use this cash to create shareholder value, whether that be through share buybacks; dividends; reinvestment (R+D); or acquisitions. Companies that are adept at doing so are the ones you want to purchase at attractive valuations and hold for the long term. PayPal and Facebook are great examples. Both companies have huge negative momentum at present, but I will be adding these to the portfolio in the near future. Other companies on my radar include AMD, Dropbox, and Adobe.

Thanks to weak hands selling several of the businesses I currently own, I believe it is an opportune time to add to some existing positions. As I have written about before, the heightened volatility has created reduced liquidity in the market as large institutions deleverage their portfolios. This has created huge price anomalies. Overstock (OSTK) has been pummelled recently, and now trades at 8x EV/EBITDA – I use this ratio because it has $500mn in cash on its balance sheet. This business will continue to boom as US housing permits continue to rise (see below). In addition, BSTK (a blockchain-enabled securities exchange) has been officially approved to launch in the US. tZero has a 50% stake in BSTK, and Overstock owns tZero. This is huge news for crypto adoption, and it is in the price of Overstock for free. OSTK can sell or spin-off these businesses as they grow, therefore creating a huge opportunity for compounded returns in my opinion. I am adding 1% ahead of its earnings next week.

US Housing Permits - at a multi-year high, Source: St Louis Fed

Summary

I believe inflation will remain high in the short-term (1-2 months) but begin to fall in the medium-term (3-6 months). This means a steady rotation from value into growth, benefitting many of my equity holdings. What if I am wrong? Fund flows into gold are finally growing (see below). If I am wrong, and inflation continues to rise, we will enter a bear market as investor’s price in huge interest rate hikes by central banks to tame inflation. Gold will cover me in this scenario, so I have decided to add 1% to Physical Gold also, following the so-called ‘whales’ (big institutions). If I am totally wrong, and we enter a recession (deflationary bust), then everything will tank and my decision to hold dry powder (cash) was great. I believe this is the most unlikely outcome.

Institutional fund flows into Gold ETFs, Source: Bytetree.com

There are some great companies on offer at ridiculous prices today, but the biggest thing holding me back is that I know cheap can get much, much cheaper. Therefore, I may build out positions in such companies over several weeks, averaging in at lower prices and increasing the size of these positions as the wider macro environment becomes clearer. No matter the outcome, if I continue to purchase great companies at a fair price, I know in the long term I will be rewarded. So that is what I will continue to do no matter my view on the macro environment, as this is the hardest to predict.

Action:

Adding 1% to Overstock (OSTK) at $39.67

Adding 1% to Physical Gold (PHGP) at £131.52

Selling 50% of iShares Oil & Gas ETF (SPOG) at £15.78, booking a 34% gain

Return YTD: 1.1% vs S&P500: -9.3%

Total Return since Inception (17/09/2021): 7.1% vs S&P500: -1.9%

Let me know your thoughts by emailing me at: thesparknewsletter@gmail.com

Until next time,

Peter

Disclaimer

This communication is for informational and educational purposes only and should not be taken nor used as investment advice, as a personal recommendation, or solicitation to buy or sell any financial instrument. This material has been prepared without considering any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or structured product are not, and should not be taken as, a reliable indicator of future performance. I assume no liability as to the accuracy or completeness of the content of this publication.